Industrial Alliance analyst Al Nagaraj says he expects a strong second half of the year from Macdonald Dettwiler (Stock Quote, Chart, News: TSX:MDA).

Yesterday, after market, Macdonald Dettwiler reported its Q2, 2013 numbers. The company earned $31.1-million on revenue of $450.4-million, up 174% over last year’s $164.-million Q2 topline.

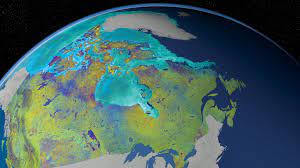

Nagaraj notes that Macdonald Dettwiler beat the street consensus revenue expectation of $442M during the quarter, but fell below his loftier prediction of $489-milion. He says this was due to delays in the Radarsat program, U.S. sequestration, and lower revenues in its communications segment.

Still, he says, Macdonald Dettwiler delivered a solid quarter in spite of the aforementioned obstacles, and he expects a growing backlog will set the company up for a strong second half to 2013. In a research update to clients this morning, Nagaraj reiterated his BUY rating and maintained his price target of $87. He derives the target by applying a multiple of 12.9x his expectation of the company’s adjusted earnings in fiscal 2014, which is $6.78 a share.

Nagaraj says the acquisition of Space Systems/Loral put MDA in play for business it could not have won in the past, including satellite ground stations in the United States and large production contracts, as SSL has manufacturing capabilities in the U.S.

Last November’s acquisition of Space Systems/Loral, which Macdonald Dettwiler CEO Dan Friedmann called “transformational” effectively doubled the size of B.C.’s largest tech company and returned it to its roots in aerospace.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment