Compared to its oncology drug peers, Canadian cancer biologics developer Oncolytics Biotech (Oncolytics Biotech Stock Quote, Chart, News TSX:ONC) is a bargain of a stock, says Douglas Loe, analyst for Echelon Wealth Partners.

Compared to its oncology drug peers, Canadian cancer biologics developer Oncolytics Biotech (Oncolytics Biotech Stock Quote, Chart, News TSX:ONC) is a bargain of a stock, says Douglas Loe, analyst for Echelon Wealth Partners.

In an update to clients Monday, Loe reiterated his “Speculative Buy” rating and $11.00 target price for ONC, saying new data on the company’s lead oncolytic virus formulation pelareorep/Reolysin is a positive for the company and stock.

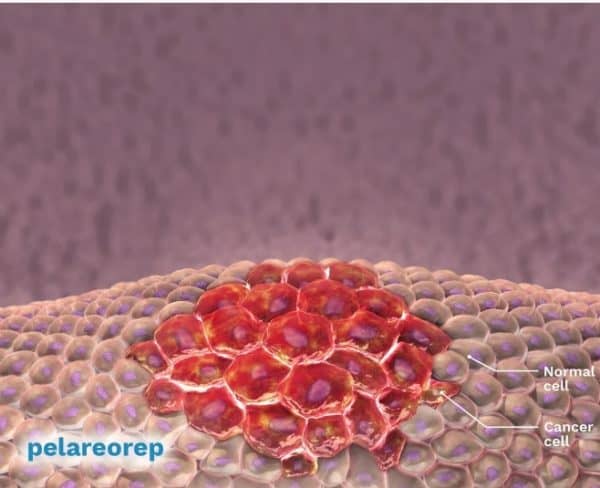

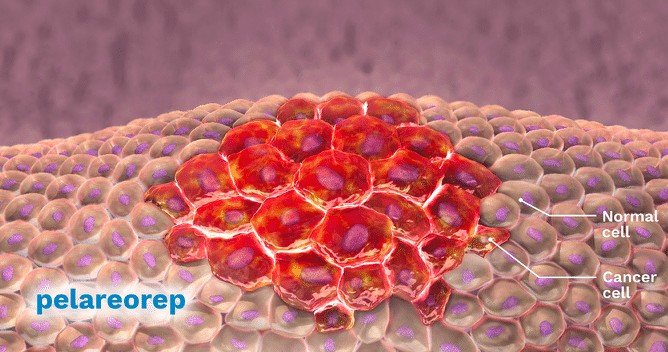

Calgary-based Oncolytics Biotech presented mechanistic laboratory and preclinical data last week on the utility of pelareorep/Reolysin at the American Society of Hematology meeting in Florida, giving insights into how the oncolytic virus could be useful in targeting multiple myeloma when co-administered with an already-FDA-approved multiple myeloma drug.

“New myeloma data were not focused on clinical tumour response and/or survival as many previous Phase I/II pelareorep trials have been (notably in breast cancer as we have described before), but still, we are encouraged by new details on pelareorep’s underlying biology that could be relevant to its utility in this specific cancer form in future clinical initiatives,” wrote Loe.

Loe’s valuation model for ONC targets pelareorep’s utility for addressing advanced metastatic breast cancer, in large part because the company has already demonstrated the positive impact of the drug on overall survival in a 74-patient Phase II trial and because ONC is itself “squarely focused on this oncology market” through follow-up Phase I/II studies either currently conducting or about to commence, said the analyst.

Loe likes the way ONC stacks up to its industry peers.

“As always, we reflect positively on how ONC’s current market value compares to its oncolytic virus development peers, many of which developed alternative oncolytic virus platforms have either been valued at, or acquired at, valuations that dramatically exceed ONC’s current market value,” said Loe.

“Relevant comparable oncolytic virus platforms include: Amgen’s/BioVex’s herpes virus-based Imlygic (innovator BioVex’s was acquired for US$1 billion; US$425 million of which was upfront cash), Merck’s/Viralytics’ coxsackievirus A1-based Catavak (acquisition value US$394 million for a melanoma-specific platform), and Boehringer Ingelheim’s (Private)/ViraTherapeutics’ vesicular stomatitis virus-based VSV-GP (take-out value was US$244 million for an oncolytic virus platform that while early-stage had wide-ranging potential across multiple cancer indications). ONC’s current enterprise value is $28 million,” he added.

As for upcoming milestones, Loe points to an expected update on an AWARE-1 trial in the next quarter or two along with a BRACELET-1 trial which is expected to start enrolment during the next quarter.

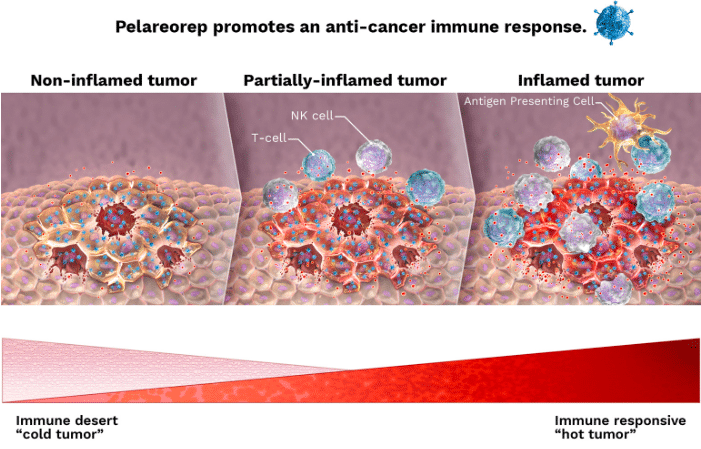

“We will be keenly interested in any insights on how pelareorep in combination with PD1/PD-L1-targeted checkpoint inhibitors could confer immunological anti-tumor activity in advanced breast cancer, and these two studies along with Phase II survival data already published could substantively de-risk our breast cancer-specific royalty revenue projections,” said Loe.

“We are separately optimistic that Asian partner Adlai Nortye could advance its own Phase II breast cancer program, for which it already has permission from Chinese regulators to proceed, in the next few quarters,” he wrote.

Loe’s $11.00 target stems from his NPV estimate (40 percent discount rate) and multiple of his fiscal 2024 EBITDA/EPS projections and, as of press time, represents a projected 12-month return of 619 per cent.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment