Investment bankers iA Capital Markets initiated coverage on Canadian marketing tech company Wishpond Technologies (Wishpond Technologies Stock Quote, Charts, News, Analysts, Financials TSXV:WISH) on Thursday, with analyst Neehal Upadhyaya starting WISH off with a “Buy” rating and $1.50 target price. Upadhyaya said Wishpond’s one-stop shop approach fills a need for the small and medium-sized business crowd.

“SMBs often lack the necessary in-house online marketing capabilities and are increasingly looking at external solutions,” Upadhyaya wrote in his report. “However, due to the fragmented market of SaaS online marketing solutions, businesses often employ several different solutions from various vendors, making it difficult to: 1) have usable analytics from the separate solutions, 2) integrate the various solutions to seamlessly work with their marketing strategy, and 3) have a cost-effective solution that is simple to use. Enter Wishpond, with a plug-and-play product that helps SMBs focus on operating their businesses, leaving marketing to the experts.”

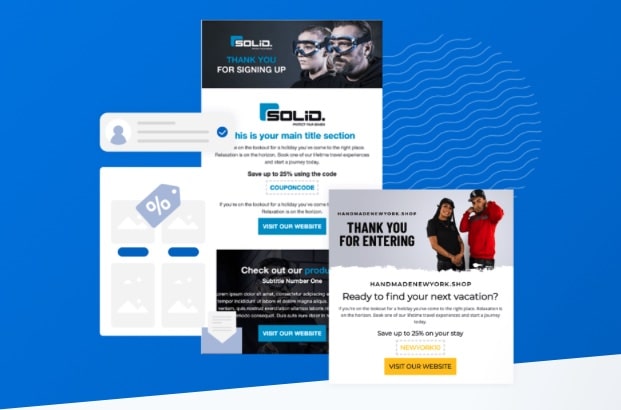

Vancouver-based Wishpond has a platform that combines marketing, promotion, lead generation and sales conversion, and the company currently has over 4,000 customers for its SaaS-based offerings. WISH has been growing by leaps and bounds, with 2021’s revenue of $14.8 million representing an 87 per cent increase over 2020. The topline growth came from acquisitions but also from increases in sales and marketing as well as from new products coming online such as an email marketing platform for customer engagement and a new Website Builder product with lead tracking and segmentation tools, pop-ups and other features to help generate leads and sales.

More recently, Wishpond’s second quarter 2022 saw revenue climb by 55 per cent year-over-year to $5.0 million, putting the company over the $20 million annualized revenue run-rate for the first time. Management said the second half of the year should see record revenues driven by its sales team’s production, integration of acquisitions and again new product-related revenue.

“Thus far, we have not noticed any slowing down in the demand for our products. In addition, Wishpond also achieved positive cash flow from operations in the second quarter,” said Chairman and CEO Ali Tajskandar, in an August 24 press release. “Our outlook continues to look promising for the second half of the year with increasing sales, improving margins, and positive cash flows. Our sales pipeline remains robust and our revenue growth shows tremendous resilience despite the current uncertain economic environment.”

For Upadhyaya, Wishpond’s recent performance shows the recession-resilient nature of its business as SMBs are finding its solutions to be effective cost-cutting measures compared to alternatives in the marketing space. As proof, the analyst pointed to WISH’s last six quarters where the lowest year-over-year growth the company has achieved was 41 per cent. Meanwhile, Upadhyaya is expecting the company to finish 2022 with adjusted EBITDA margins of 2.5 per cent in the third quarter and 4.6 per cent in the fourth, with free cash flow coming in at $199,000 and $521,000, respectively.

“Rarely do companies boast revenue growth achieved by WISH while being Adj. EBITDA positive and generating positive FCF,” Upadhyaya said. “With revenue multiples significantly contracting due to an increase in cost of capital along with recessionary pressures attracting investors to companies with strong fundamentals and profitability, WISH is a unicorn of sorts providing the best of both worlds.”

On the M&A front, Wishpond has so far completed five acquisitions to expand and develop its suite of products, with Upadhyaya estimating $7.2 million in added revenue through acquisitions. The analyst pegged WISH’s annual organic growth rate at over 30 per cent over the last four years and he pointed to the company’s “highly effective” outbound sales and marketing activities as a difference-maker, where he estimated each $1.00 spent has yielded about $3.40 in revenue.

Upadhyaya said the current environment has made raising money and/or diluting the company’s current investor base not very attractive options for WISH’s management, and thus, the company is likely to be relying on organic growth to help fund the business, which is not a bad option to have on hand, Upadhyaya said.

“Wishpond has a proven sales engine with a highly predictable Customer Lifetime Value to Customer Acquisition Cost ratio of 3.4:1. With this sales engine, WISH can, through the cash it generates, increase its sales and marketing spend to continue to grow at an impressive clip, all organically,” he said.

Wishpond shares initially shot up upon their debut in December, 2020, but the pullback over the past year and a half has been steep, taking WISH from a brief high of around $2.20 in early 2020 to now around $0.70 per share.

But Upadhyaya sees upside from current levels. At press time, his $1.50 target price represented a projected one-year return of 130.8 per cent.

Upadhyaya said Wishpond shares are currently trading at a “significant” discount to their peer group, with WISH currently at 1.1x his 2023 EV/Revenue estimate, which is well below its Canadian SaaS peer average at 5.4x and its North American Marketing comparables at 4.4x.

“Due to this deep discount, the ability to sustain growth through cash flow generated and the M&A upside, we believe that Wishpond is a rarified company on the TSX.V since we expect that it will be Adjusted EBITDA positive and have positive cash flows from operations in 2022,” Upadhyaya said. “We believe that the risk/reward profile is compelling at these levels.”

Disclosure: Wishpond Technologies is an annual sponsor of Cantech Letter.

Share

Share Tweet

Tweet Share

Share

Comment