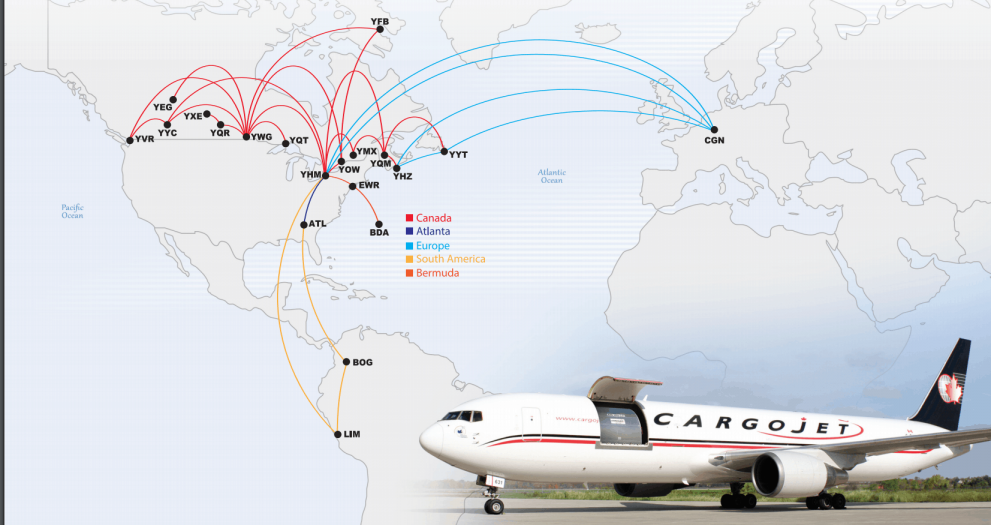

Following the company’s fourth quarter results, Beacon analyst Donangelo Volpe has maintained his “Buy” rating on Cargojet (Cargojet Stock Quote, Chart, News, Analysts, Financials TSX:CJT).

On February 17, Cargojet announced its Q4 and fiscal 2024 results. In the fourth quarter, the company posted Adjusted EBITDA of $91.7-million on revenue of $293.2-million, up from $221.9-million a year prior.

“Cargojet produced very strong results for the fourth quarter and full year 2024 delivering on our financial and operational objectives. For the full year we reached a record and historic milestone of over $1 billion in revenues for the first time in Cargojet’s history. Our strong, diversified business model has proven resilient in times of economic uncertainty, and we remain focused on driving operational efficiency and maintaining strategic flexibility to harness new growth opportunities and protect margins,” co-CEO Jamie Porteous said.

The analyst summarized the quarter.

“Q4/FY24 consolidated revenue was $293M, ahead of our estimate of $269M and consensus $273M with estimates ranging from $264M-$285M. Revenue was up 19% q/q and 32% y/y. Importantly, revenue from domestic network, ACMI and all-in charter was $251M up 30% y/y. Domestic network revenue increased 2% y/y due to an improvement in e-commerce and B2B volumes. ACMI revenue increased 29% y/y due to additional aircraft deployment on short-term basis as well as an increase in ad hoc flights. All-in charter revenue increased 136% y/y due to the scheduled charter services between China and Canada. CJT reported a 16% productivity improvement in block hours sequentially. Cash generated from operating activities was $104M compared to $32M last year. Adjusted EBITDA was $92M, ahead of our estimate of $91M and consensus $90M with estimates ranging from $87M-$97M. Adj EPS came in at $1.71 compared to our estimate of $1.42 and consensus $1.58, with estimates ranging from $1.26-$1.73.”

In a research update to clients February 19, Volpe maintained his “Buy” rating and price target of $165.00 on CJT, implying a return of 52% at the time of publication.

The analyst thinks the company will post EBITDA of $353.0-million on revenue of $1.04-billion in fiscal 2025.

“Following the Q4 results, we have made upward revisions to our FY25 estimates and have introduced our forecast for revenue of $259M, adj EBITDA of $82M and adj EPS of $1.00. We maintain our Buy rating and $165/sh PT for CJT which is based on 9.5x FY25 adjusted EBITDA multiple,” the analyst added.

Share

Share Tweet

Tweet Share

Share

Comment